Introduction

In the world of financing, couple of names resonate as strongly as that of Marc Lasry. As the co-founder and CEO of Avenue Capital Group, Lasry has actually sculpted a remarkable specific niche for himself in the financial investment landscape. With decades of experience under his belt, he's not simply another billionaire financier; he's an authority on distressed assets and credit chances. This article looks for to delve deep into the state of mind and strategies that have moved Marc Lasry to billionaire status. We'll explore his financial investment approaches, discuss his views on market trends, and present insights that aspiring investors can Avenue Capital team learn from.

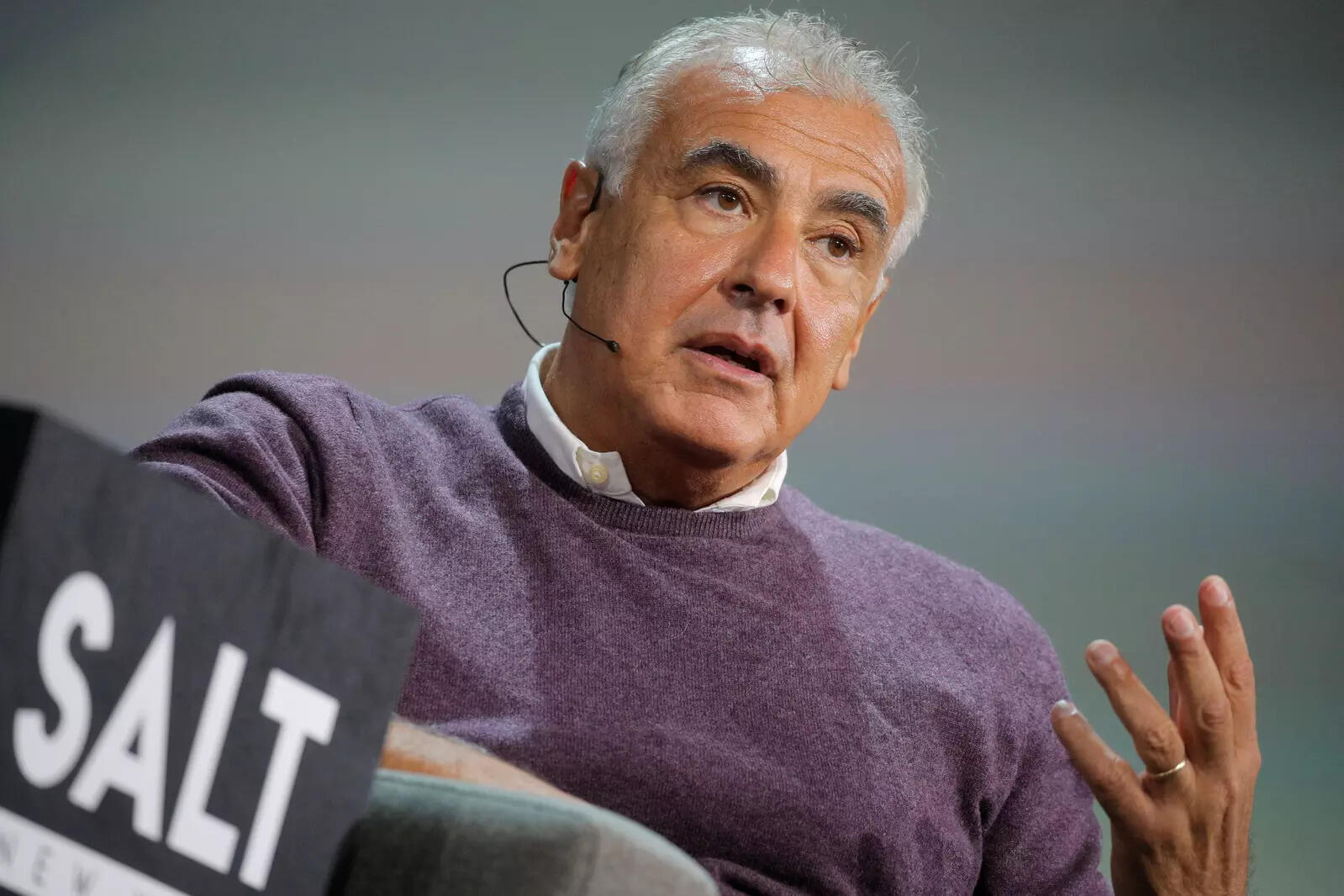

Inside the Mind of a Billionaire Investor: A Discussion with Marc Lasry

Marc Lasry's point of view on investing is formed by both individual experience and market dynamics. He approaches investing with an unique blend of analytical rigor and psychological intelligence. Something that's abundantly clear is that he understands danger-- not just in regards to numbers but likewise in how it affects people and businesses.

The Early Days: From Law to Investment

A Special Background in Law

Before entering the world of finance, Marc Lasry earned his law degree from New york city University School of Law. His legal background used him vital abilities in negotiation and critical thinking-- characteristics that would serve him well in investment management.

Transitioning to Finance

Lasry didn't stick to law for long; he rapidly discovered his enthusiasm lay in other places. He made the leap into finance at a time when many were hesitant to buy distressed properties. His early experiences supplied him with insights that would later on define Avenue Capital's strategic focus.

Founding Avenue Capital: A Vision Realized

Avenue Capital's Objective Statement

Established in 1995, Avenue Capital was founded on the property that chances exist even when markets are down. The firm specializes in distressed financial obligation financial investments, focusing primarily on companies facing financial troubles yet possessing strong underlying value.

The Growth Trajectory

Under Lasry's management, Avenue Capital has actually grown substantially, managing billions in properties across various funds. His ability to identify underestimated possessions has ended up being almost famous amongst investors.

Investment Approach: The Core Principles

Understanding Distressed Investments

Lasry thinks that distressed investments need a nuanced understanding of both market conditions and human psychology. He typically states that buying distressed properties isn't simply about numbers; it's about acknowledging possible where others see failure.

Risk Management Strategies

Effective threat management is crucial for any financier, however especially for those like Lasry who run in unpredictable markets. He emphasizes diversity, extensive research, and preserving liquidity as primary methods to mitigate risks.

Market Analysis: Patterns That Forming Investment Decisions

Current Economic Environment

Today's economic landscape provides both challenges and chances for investors. Inflation rates are changing, interest rates are increasing, and geopolitical tensions are ever-present-- factors that Lasry carefully monitors.

Sector-specific Insights

Lasry often shares insights about sectors poised for development regardless of financial downturns. For example, technology and healthcare stay durable even throughout tough times due to their necessary nature.

Lessons for Aspiring Investors: What Can We Learn?

Patience is Key

One recurring theme in discussions with Marc Lasry is persistence. Effective investing isn't about fast wins however rather about waiting on the ideal moment to capitalize on an opportunity.

Continuous Learning and Adaptation

The financial investment landscape is always developing-- what worked the other day might not work tomorrow. Lasry supporters for constant education and adaptation as vital components of an effective financial investment strategy.

The Human Element: Emotional Intelligence in Investing

Building Relationships with Stakeholders

For Lasry, investing isn't solely transactional; it's about developing relationships with companies' management groups and comprehending their visions for healing or growth.

Empathy Towards Distressed Companies

Recognizing the human element behind every distressed possession permits investors like Marc Lasry to make educated decisions while also fostering goodwill within communities impacted by financial downturns.

Philanthropy: Giving Back Through Financial Investment Wisdom

Impact Investing Initiatives

Beyond profit-making endeavors, Lasry engages greatly in philanthropy through impactful investments targeted at social great-- a testament to his belief that wealth includes responsibility.

Sharing Knowledge Through Mentorships

Lasry does not shy away from sharing his wealth of knowledge with budding financiers through mentorship programs focused on fostering the next generation of monetary leaders.

Frequently Asked Questions (FAQs)

Who is Marc Lasry?- Marc Lasry is a billionaire financier called the co-founder and CEO of Avenue Capital Group, concentrating on distressed debt investments.

- Avenue Capital is an investment firm concentrated on recognizing opportunities within distressed properties across various markets globally.

- He mainly focuses on distressed investments but also takes notice of sectors like technology and healthcare.

- Emotional intelligence plays a vital function; comprehending human aspects can cause better decision-making.

- Yes, he actively takes part in philanthropy through effect investing initiatives aimed at producing positive social change.

- Patience is crucial; successful investing requires waiting on optimal moments instead of looking for instant returns.

Conclusion

Understanding "Inside the Mind of a Billionaire Financier: A Conversation with Marc Lasry" provides indispensable insights into what makes him tick as an investor-- and indeed what can direct others seeking to navigate this complicated field effectively. From mastering threat management strategies to embracing emotional intelligence, there are lessons aplenty to be gleaned from his experiences at Avenue Capital Group.

As we've explored throughout this post, success doesn't merely come from financial acumen however also from empathy towards those involved-- be they clients or companies dealing with adversity. By applying these principles diligently while staying adaptable amidst altering market characteristics, anybody can aspire towards investment quality reminiscent of what Marc has actually attained over decades invested honing his craft.

In closing, remember that every considerable journey starts with a single step-- accepting understanding today could very well set you up for significant success tomorrow!