Introduction

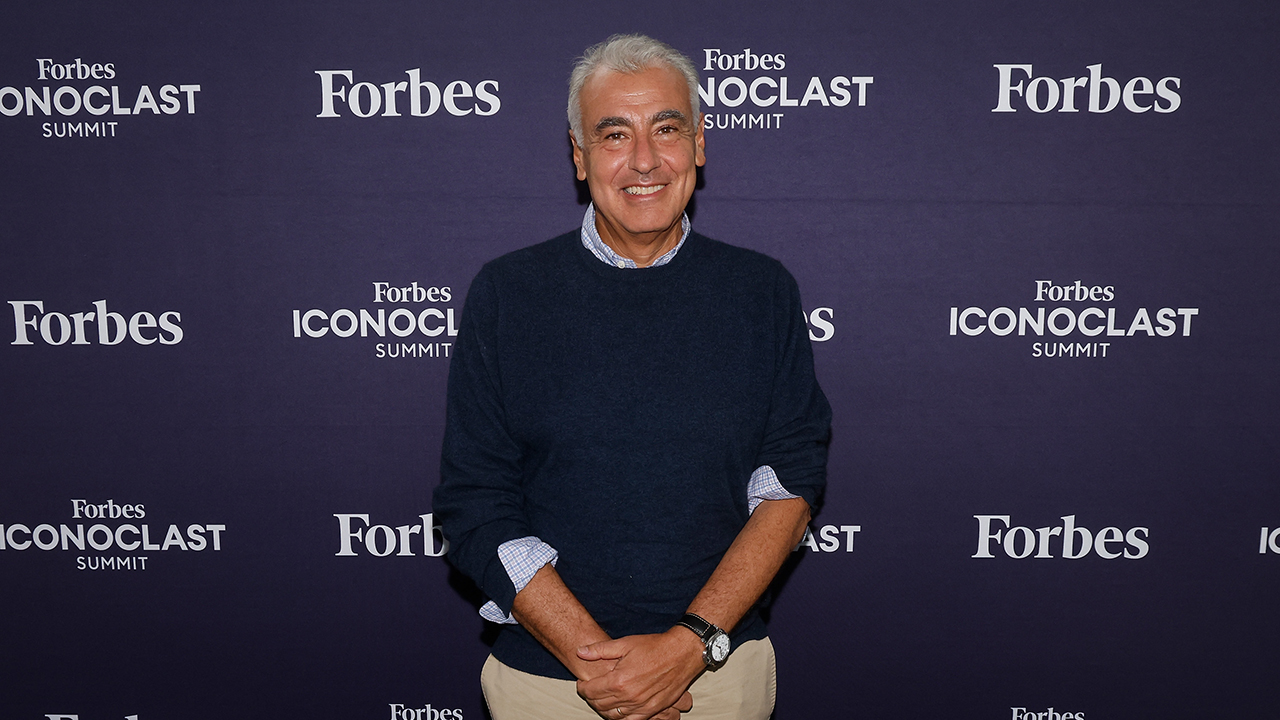

In the high-stakes world of investing, where decisions can cause substantial financial gains or https://dailyplanetdc.com/2025/02/19/hedge-fund-success-marc-lasrys-key-principles-behind-avenue-capital/ disastrous losses, one might assume that large analytical prowess is the key to success. Nevertheless, one popular figure in finance, Marc Lasry, co-founder of Avenue Capital Group, argues that emotional intelligence (EI) plays a pivotal role in effective investing. This post delves into why psychological intelligence matters in investing according to Marc Lasry, exploring its implications for decision-making, danger assessment, and total financial investment strategy.

What is Emotional Intelligence?

Emotional intelligence describes the ability to acknowledge and handle our own feelings along with comprehend the feelings of others. It incorporates skills such as compassion, self-regulation, social skills, motivation, and self-awareness. For financiers like Marc Lasry, these abilities can significantly influence their technique to monetary markets.

The Components of Emotional Intelligence

Self-Awareness- Recognizing one's feelings and their influence on ideas and behavior.

- The capability to manage disruptive emotions and impulses.

- Harnessing feelings to pursue objectives with energy and persistence.

- Understanding the emotional makeup of other people and treating them according to their emotional reactions.

- Managing relationships to move individuals in desired directions.

Why Emotional Intelligence Matters in Investing, According to Marc Lasry

Marc Lasry has consistently highlighted that effective investing isn't exclusively about numbers; it's about comprehending the human element behind those numbers. Human feelings can drive market trends more exceptionally than any algorithm or analysis.

The Mental Element of Investing

Investing typically involves making choices under pressure. The worry of loss or the thrill of possible gain can cloud judgment. Emotional intelligence allows financiers to navigate these psychological obstacles effectively.

Managing Worry and Greed: The balance between fear and greed is crucial for effective investing. Investors with high emotional intelligence can recognize when they're being affected by these sensations and adjust their strategies accordingly.

Making Logical Choices: Strong EI helps financiers stay calm during volatility in the markets-- enabling more rational decision-making rather than spontaneous responses driven by emotion.

The Role of Empathy in Financial Investment Decisions

Understanding others' perspectives is essential in finance; after Avenue Capital all, markets are driven by human behavior.

Building Trust with Stakeholders

Marc Lasry emphasizes that empathetic investors develop much better relationships with stakeholders-- including clients, partners, and team members-- leading to more educated decision-making.

- Cultivating Long-Term Relationships: An investor who comprehends their clients' requirements is most likely to tailor financial investment strategies that align with those needs-- leading to higher complete satisfaction and trust.

Anticipating Market Movements

By understanding collective sentiment through compassion, smart investors can prepare for market movements that may not be immediately apparent through information alone.

Risk Management Through Psychological Intelligence

Effective risk management surpasses analytical analysis; it requires an understanding of how emotional actions can alter understandings of risk.

Identifying Behavioral Biases

Many financiers fall victim to cognitive predispositions-- errors rooted in emotional reasoning instead of factual analysis.

- Common Biases: Confirmation Bias: Favoring info that confirms existing beliefs. Loss Aversion: The tendency to prefer preventing losses over acquiring equivalent gains.

Emotional intelligence enables investors like Marc Lasry to acknowledge these biases within themselves and others-- an important skill for mitigating dangers related to poor decision-making.

Decision-Making Under Stress

In high-pressure scenarios-- like market recessions-- psychological intelligence ends up being important for maintaining clarity in the middle of chaos.

Staying Calm Throughout Crises

The capability to manage one's feelings permits financiers to believe clearly even when faced with demanding scenarios:

- A calm state of mind fosters abstract thought rather than panic-driven responses that could lead to bad investment choices.

Reflecting Before Acting

Lasry advocates for a reflective approach before making substantial financial investment relocations-- a strategy rooted in self-regulation and thoughtful factor to consider instead of impulsivity driven by stress or fear.

Integrating Psychological Intelligence into Investment Strategies

Investors must not just cultivate their own EI however likewise promote it within their groups and organizations for higher collective success.

Training Programs Concentrated on EI Development

Organizations like Avenue Capital might execute programs targeted at improving emotional intelligence amongst workers:

- Workshops on communication skills Activities promoting team cohesion Regular feedback sessions focusing on interpersonal dynamics

These efforts help create an environment where emotionally intelligent decisions flourish-- directly affecting financial investment outcomes positively.

Success Stories from Marc Lasry's Career at Opportunity Capital

Lasry's profession provides numerous examples showing how emotional intelligence has formed effective investments at Avenue Capital Group:

Navigating Market Volatility Successfully

During challenging financial durations-- such as the 2008 financial crisis-- Lasry's focus on EI allowed him not just to make sound financial investment options but also guide his group through rough times efficiently:

- By focusing on open communication and assistance within his organization during crisis minutes helped keep spirits while tactically navigating risky waters.

Building a Resilient Group Culture at Opportunity Capital

His commitment extends beyond individual efficiency; he targets at cultivating a durable culture where every worker feels valued:

- This collaborative spirit reinforces decision-making processes within his company while ensuring everybody contributes toward shared goals aligned with customer success stories too!

The Balance Between Information Analysis and Emotional Insight

While data-driven strategies are essential aspects of modern-day investing practices today-- the integration in between quantitative analysis supported by qualitative insights collected by means of EI proves important too!

Leveraging Data Without Losing Sight Of Individuals Behind It All!

Investors must remember there are real individuals behind every number on spreadsheets! Stabilizing strenuous data analysis along with intuitive understanding acquired through EI suggests preventing tunnel vision frequently associated entirely trusting raw statistics alone!

As Marc Lasry puts it succinctly: "Numbers inform part of the story-- but human behaviors reflect deeper facts!"

Conclusion: The Future of Investing Requires Psychological Intelligence

In conclusion, as we consider how finest navigate unforeseeable financial landscapes ahead-- we should acknowledge that incorporating psychological intelligence into our investment practices will be important progressing!

Marc Lasry's insights supply valuable lessons about striking this balance efficiently in between analytical rigor & & compassionate connections within both clients & & coworkers alike!

To be successful in today's hectic world of financing-- a nuanced technique integrating hard data AND soft abilities equips us far much better than either one alone ever could!

FAQs

Q1: How does psychological intelligence vary from IQ?

A1: While IQ steps cognitive abilities like analytical abilities and rational reasoning, psychological intelligence stresses recognizing one's own emotions as well as understanding others' sensations-- an important aspect particularly relevant within interpersonal contexts such as investing!

Q2: Can emotional intelligence be learned or improved?

A2: Yes! Unlike IQ-- which tends mainly predetermined throughout life-- emotional intelligence can undoubtedly be cultivated through practice gradually through training programs focused improving self-awareness/social abilities etc, leading eventually towards better results across numerous domains consisting of finance!

Q3: How essential is empathy when making financial investment decisions?

A3: Empathy permits financiers recognize various viewpoints influencing market trends thus allowing them expect movements potentially missed out on if relying exclusively upon numeric analyses alone!

Q4: What role does self-regulation play throughout unstable markets?

A4: Self-regulation helps preserve composure amid crises avoiding rash actions triggered by fear/greed assisting make sure strategic choices made rather yield beneficial outcomes long-lasting!

Q5: Exist particular strategies for developing greater psychological intelligence?

A5: Strategies include mindfulness exercises intended increasing awareness around personal sensations along practicing active listening abilities engaging constructively with others fostering much deeper connections total boosting relationship-building efforts essential within any field consisting of finance!

Q6: Why need to financial institutions focus on training programs related EI development?

A6: By prioritizing such efforts companies produce environments conducive collaboration/mutual assistance leading towards enhanced morale overall which translates straight into boosted efficiency throughout all levels staff thus benefiting clients too!

In today's quickly developing landscape filled with unpredictabilities-- financial professionals would do well welcome lessons imparted by industry leaders like Marc Lasry emphasizing value including elements promoting emotional awareness along with standard approaches making sure continual success long-term!